Project Phase:

NI 43-101 Resource

View Technical Report

Commodity:

Uranium

Size:

3,640 acres

Location:

Fall River County, South Dakota

Project Overview

The Chord property is comprised of 147 contiguous lode mining claims (~ 3,037 acres) located in Edgemont, South Dakota approximately 3 miles southwest of encore Energy Corp.’s (NYSEAM:EU) Dewey-Burdock development project which is targeting initial production in 2025.1 Mineralization at Chord is hosted within typical roll front deposits in the Cretaceous age Fall River and Lakota formations, in particular the Chilson member which is the same host for mineralization at Dewey-Burdock. The property has been the subject of extensive exploration since the 1970’s with over 1,000 holes drilled by Union Carbide Corp. (“UC”) which led to the tabling of an internal resource and feasibility study.

enCore Energy’s adjacent Dewey-Burdock project is host to a M&I resource of 17.1 Mlbs U3O8 (7.4 Mt at 0.116% U3O8) plus an Inferred resource of 0.7 Mlbs U3O8 (0.6 Mt at 0.055% U3O8), a positive Preliminary Economic Assessment (PEA)2 outlining a low-impact in-situ recovery (ISR) operation producing 14.3 Mlbs U3O8 at an all-in sustaining cost of US$28.88/lb U3O8. The Dewey-Burdock project also has received its Radioactive Materials License (RML) from the U.S. Nuclear Regulatory Commission (NRC) and is currently navigating the State Licensing process.

Basin is acquiring a up to a 90%-interest for a total of US$50K in cash, US$950K in stock, and US$1.2M in exploration with the timing dependent on the receipt of permits from applicable regulatory authorities in accordance with the terms of the Option Agreement (see March 3rd, 2023 Press Release).

1 enCore Energy February 2023 Corporate Presentation “enCore: production pipeline”

2 Azarga Uranium NI 43-101 PEA dated December 22, 2020

Mineralization

NI 43-101 Resources

| Uranium Inferred Mineral Resource Area | GT Cutoff (ft%) | AVG. Thickness (ft) | AVG. Grade (%eU3O8) | Tons (Millions) | Pounds (e U3O8) (Millions) |

| October-Jinx | 0.25 | 8.8 | 0.081 | 1.584 | 2.569 |

| Viking | 0.25 | 6.0 | 0.082 | .050 | .082 |

| Ridge Runner | 0.25 | 5.9 | 0.069 | .075 | .103 |

| Total Inferred Mineral Resource | 0.25 | 8.5 | .081 | 1.709 | 2.754 |

Pounds and tons as reported are rounded to the nearest 1,000. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Notes to the NI 43-101

- The MRE has an Effective Date of May 7, 2024.

- The Qualified Person for the MRE is Mr. Carl Warren, P.E., P.G., whom is a Senior Engineer for BRS Engineering in Riverton, Wyoming.

- Mineral resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines, as required by NI 43-101.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. Additional drilling will be required to convert Inferred Mineral Resources to indicated Mineral Resources or Mineral Reserves. There is no certainty that any part of a Mineral Resource will ever be converted into Mineral Reserves

- All data used in the MRE consists of original drill hole maps and geophysical logs and was sourced from a combination of the South Dakota Geological Survey and private parties.

- The MRE was performed using the Grade time Thickness (GT) contour modeling method.

- The available original data was evaluated for authenticity and the equivalent uranium oxide (eU3O8) grades recalculated from the original gamma curves using K factor, deadtime, water and air factors clearly stated on each original geophysical log.

- A disequilibrium factor of 1 was applied to the resulting eU3O8 intercept dataset.

- An intercept grade cutoff of 0.02% eU3O8 was applied to the grade data to screen for intercepts which are not economically extractable by conventional heap or milling methods.

- Intercept data meeting the grade cutoff criteria were split into mineral horizons based on 3-dimensional interpretation of geological units and were composited and modeled within each horizon using a minimum 0.1 GT cutoff, a maximum vertical distance of 10 feet between intercepts, and a maximum radius of influence of 200 feet between drill holes.

- Three Mineralized Horizons were Identified by 3-dimensional interpretation and modeled: Horizon A being the highest in elevation, C being the lowest in elevation and B residing between A and C.

- These mineral horizons are variably present within the three project areas: October-Jinx, Viking, and Ridge Runner.

- A bulk density of 14 ft3/ton (2.288 tonne/m3) was applied for the MRE in mineral horizons B and C. For mineral resource estimations in the Fall River sandstone, Horizon A, a bulk density of 15.5 ft3/ton (2.067 tonne/m3) was used.

- A marginal economic GT cut off of 0.25 was further applied to the GT model, based on US$70 per ton average conventional underground mining costs and US$90 per pound U3O8 assumptions for reasonable eventual economic extraction.

- Moreover, isolated, and small pods of mineralization were removed from the MRE due to lack of reasonable eventual economic extraction.

- Figures are rounded to reflect the relative accuracy of the estimate and may not sum due to rounding.

- Resources are presented as undiluted and in-situ, are constrained by the GT contour model for each mineral horizon, and

- The Qualified Person is not aware of environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resources.

Exploration Target

| Exploration Target Trend | Trend Length (ft) | Trend Width (ft) | AVG. Thickness Range (ft) | AVG. Grade Range (%eU3O8) | Tons Range (Millions) | Pounds (e U3O8) Range (Millions) |

| Viking-Runner | 7,650 | 400 | 3.6 – 7.3 | 0.056 – 0.074 | 0.730 – 1.635 | 0.813 – 2.419 |

| Jinx Ridge | 2,480 | 400 | 3.6 – 7.3 | 0.056 – 0.074 | 0.249 – 0.559 | 0.278 – 0.826 |

| October South | 1,860 | 600 | 3.6 – 7.3 | 0.056 – 0.074 | 0.298 – 0.668 | 0.332 – 0.989 |

| Total | 11,990 | 3.6 – 7.3 | 0.056 – 0.074 | 1.278 – 2.862 | 1.422 – 4.234 | |

| The potential quantity and grade disclosed above are conceptual in nature and there has been insufficient exploration to define a mineral resource at these targets. Further exploration is needed to test them for mineralization. No guarantee is made that any future resource will be delineated by future exploration. | ||||||

Adjacent Projects

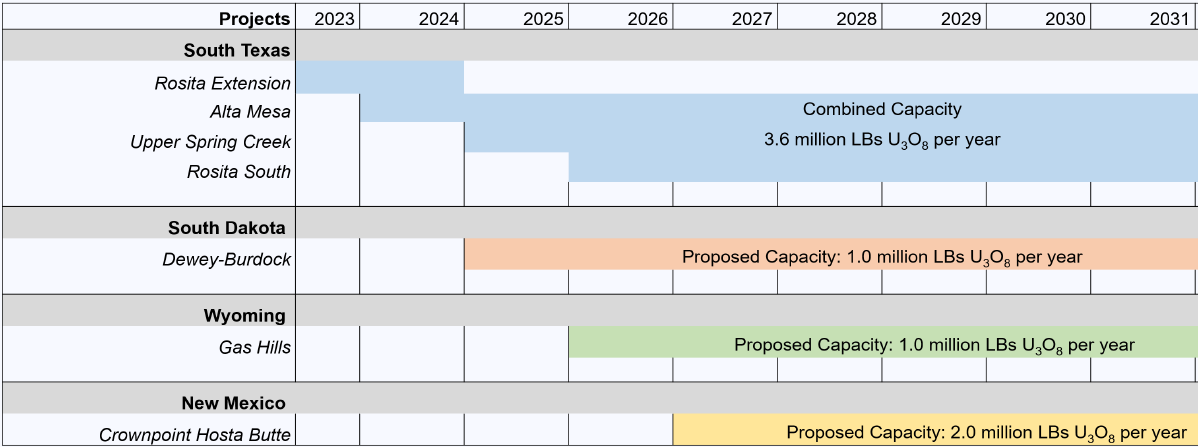

- Dewey-Burdock Project located 3 miles SW of Chord is owned by enCore Energy Corp (NYSEAM:EU)

- Project is host to a M&I resource of 17.1 Mlb U3O8 grading 0.116% U3O8 and Inferred resource of 0.7 Mlb grading 0.055% U3O8.4

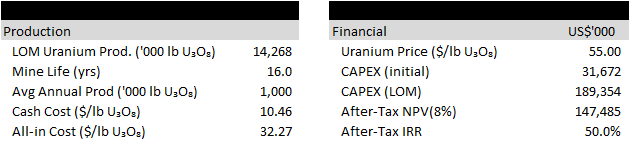

- A December 2020 PEA5 outlined life-of-mine (LOM) production of 14.3 Mlb U3O8 over a ~16 year mine life (steady-state production of 1.0 Mlb U3O8/yr) at a cash cost of US$10.46/lb U3O8 and all-in cost of US$32.37/lb U3O8. Using a uranium price of US$55/lb U3O8 and initial CAPEX of US$31.7M (US$189.4M LOM), the project generated an after-tax NPV8% of US$147.5M and IRR of 50%.

- enCore has publicly stated initial production targeted for 2025.6

- The project has received its Radioactive Materials License (RML) from the U.S. Nuclear Regulatory Commission (NRC) and is currently navigating the State Licensing process.

7.https://frcheraldstar.com/news/3940-fifty-six-percent-of-voters-say-uranium-mining-is-nuisance

Historical Exploration

Uranium was discovered in the southern Black Hills in 1951. Shortly after the Atomic Energy Commission (AEC) established an ore buying station in Edgemont, South Dakota. Mines Development Inc. began a milling operation in 1956.

The claims that make up the Chord today were discovered and mined in the 1950’s. The property is eight miles north of Edgemont, S.D. Production came from a large number of small deposits in both the Fall River and Lakota Formations.

Union Carbide purchased the Chord property in 1974. Exploration on the property led to a number of new mineralized areas being discovered. Baseline environmental and studies were conducted and a mine construction firm was hired to drive a 2,000 foot exploration decline into the October Jinx orebody.

In 1982, the property was leased to American Gold Minerals. Ultimately, the uranium market declined to the point where Union Carbide elected walk away from their South Dakota properties.

Strathmore Resources acquired claims covering the majority of known mineralization in 1998 and additional surrounding claims were staked during the mid – 2000’s uranium cycle by Tournigan Energy, Denver Uranium, and Neutron Energy.

Tim Henneberry, P.Geo, consultant to for Basin Uranium is the Qualified Person as defined by National Instrument 43-101 and has approved the technical information on this website.