Basin Uranium Signs Definitive Agreement for Wray Mesa Acquisition

VANCOUVER, B.C. CANADA, March 30, 2022, BASIN URANIUM CORP. (CSE: NCLR) (OTC:BURCF) (FRA:6NP0) (“Basin Uranium” or the “Company”) is pleased to announce the Company has finalized and executed an Amalgamation Agreement with 1290945 B.C. Ltd (“NumberCo”) (the “Agreement”) pursuant to which a wholly-owned subsidiary of Basin Uranium will amalgamate with NumberCo. The principal asset of NumberCo is a 100%-interest in the Wray Mesa project (the “Property”) in San Juan County, Utah.

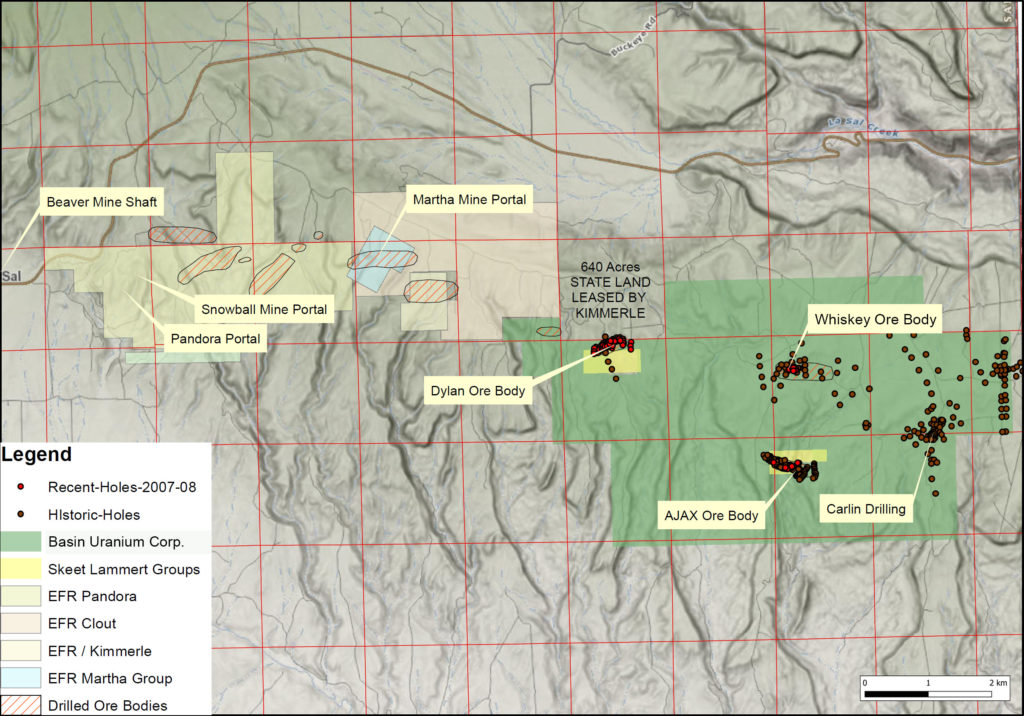

The Property is comprised of 301 unpatented lode claims totalling 6,219 acres located in San Juan County, Utah. The Property is accessible via Utah State Highway 46 and unpaved Forest Service Roads, with access to power, water and proximal to the town of La Sal. The Property is contiguous to and adjoins Energy Fuel’s (EFR-T, UUUU-NYSE) fully-permitted and production-ready La Sal project which includes a number of past-producing uranium and vanadium mines (production of 550,000 lbs U3O8 in 2012). The La Sal project is host to Measured & Indicated resources of 4.1 Mlb of uranium (U3O8) plus 21.5 Mlb of vanadium (V2O5) plus Inferred resources of 0.4 Mlb of uranium plus 1.9 Mlb of vanadium (source: Technical Report on the La Sal District Project, prepared for Energy Fuels Inc. by D.C. Peters and dated March 25, 2014.).

“The Wray Mesa project provides a second significant property to Basin’s portfolio, allowing for seamless year-round exploration in a prolific and well-established district. The Company believes that the Wray Mesa has the potential to host multiple uranium-vanadium deposits.” commented Mike Blady, CEO of Basin Uranium. “There has been a significant amount of past exploration, with over 495 holes drilled dating back to the late 1970’s, which have identified multiple mineralized zones across the property. Additionally, the historical exploration never evaluated these mineralized zones for their vanadium potential, which in the district average between 5:1 and 6:1 vanadium to uranium, adding another exciting dimension to the project. We are looking forward to putting together an exploration program and begin the permitting process to rapidly demonstrate the potential of this project.”

Wray Mesa Project Overview

Uranium and vanadium production in the district dates back to the early 1900’s with the majority of the production derived from the Upper Salt Wash Member of the Morrison Formation (the ‘Formation’). Work by previous operators discovered multiple areas of uranium-vanadium mineralization in the same geologic formation that accounted for the majority of production in the district. Mineralization on the property occurs at depths of 500 to 750 feet with the drill-defined mineralization thicknesses ranging from 25 to 75 feet. Mineralization is typical sandstone-hosted tabular deposits wherein the uranium occurs in reduced and altered sandstones and sandstone-mudstones in major stream channels in the Formation. The majority of historical drilling was completed between 1976 and 1983, with a total of 495 exploration holes, and in 2007-2008, with an additional 15 holes drilled (noting some of the historical drilling was on 3rd party claims not currently owned). The Company has engaged consultants to secure permits for an upcoming exploration program.

Transaction Terms

Under the executed Definitive Agreement, Basin Uranium Corp. is acquiring all of the issued and outstanding securities of NumberCo for 4,268,529 million shares of Basin Uranium Corp. as well as 250,000 shares to the original property vendor. The shares issued in conjunction to the acquisition will be subject to the following restrictions on transfer: 50% will be free trading on issuance with further tranches of 10% to be released monthly starting on the fifth month anniversary of closing. Basin will be required within 18-months of closing to complete a minimum C$1.0 million exploration program on the Property. The property is subject to a 1.25% net smelter return (the “NSR”) royalty on future production of which sixty percent of the royalty (being 0.75%) can be repurchased for C$500,000 and the remaining forty percent of the royalty (being 0.5%) can be can be repurchased for C$750,000. The transaction is expected to close within the coming days and is subject to customary closing conditions including the shareholder approval of NumberCo, regulatory and exchange approval.

Figure: Wray Mesa Project Acquisition

Qualified Person:

R. Tim Henneberry, PGeo (B.C.), a technical advisor to the Company, is the Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the technical data in this news release.

About Basin Uranium Corp.

Basin Uranium Corp. is a Canadian junior exploration company focused diversified mineral resources. The Company recently acquired an option to acquire a 75% interest in the Mann Lake uranium project, located in the Athabasca basin in Northern Saskatchewan, Canada, and is also currently undertaking the CHG gold exploration project located approximately 15 kilometers northwest of the town of Clinton in south-central British Columbia. The CHG Project consists of seven contiguous mineral claims covering 3,606 hectares.

For further information, please visit https://basinuranium.ca or email [email protected].

On Behalf of the Board of Directors

Mike Blady

Chief Executive Officer

[email protected]

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this news release.

FORWARD-LOOKING STATEMENTS:

Cautionary Note Regarding Forward-Looking Statements: This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this news release. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary include, without limitation, uncertainties affecting the expected use of proceeds. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.